Banking Made Easy

We offer a high-quality service to our clients and have features like a Mobile App, Online Banking, among others. Agib Bank offers Online Banking & a Dedicated Mobile App service that can provide you with the convenience of accessing your account using just your Computer, Laptop, or Mobile Phone.

Easily manage your account via the Online Banking Portal or the Agib Bank Mobile App.

AGIB ATM Card

Agib Bank offers a simple and easy banking experience for all our Clients. With an ATM Card, you can easily withdraw cash from any of our ATMs located at all Agib Bank Branches as well other strategic locations.

Your Cash in your Wallet with an Agib Bank ATM Card.

Purifying Your Wealth With Agib Bank

AGIB SAVINGS ACCOUNT

AGIB Savings account has no limit of withdrawal and we ensure that your money is kept safe, secured, and accessible. The minimum opening balance is D300.

HAJJ SAVINGS ACCOUNT

This is strictly a savings for intending pilgrims and no withdrawal till the end. It is available to individuals, groups, and organizations.

AGIB ORR ACCOUNT

This is a premium investment account that seeks to mobilize long-tenured deposits for investment in productive ventures. The minimum deposit is 1 Million.

AGIB CURRENT ACCOUNT

This account facilitates the Management and operations of all financial transactions for individuals, companies, and organizations.

Agib Products

MANUFACTURING AND CONSTRUCTION FINANCING

The Manufacturing/Construction Financing facility is to assist our customers to Manufacture or Construct an asset of their choice. The bank offers this financing through a hybrid contract of Istisna’a and Wakalah contract.

AGRICULTURE FINANCING

The Salam Financing facility is to pre-finance our customers for Agriculture production and working capital financing for the agriculture value chain. The bank may finance the customer to purchase agricultural inputs, working capital, and raw materials.

CONSUMER GOODS FINANCING

The Consumer Goods Financing facility is to assist our customers to manage their liquidity needs. Agib Bank offers Consumer Goods financing products for customers using the Murabaha and Service Ijara contracts.

FIXED ASSET FINANCING

The Fixed Assets Financing facility is to assist our customers to buy Fixed Assets of their choice, assets such as Furniture, Equipment/machinery, Laptops/Computers, Televisions, etc. This is done through Murabaha and Ijara contracts.

ISLAMIC HOME FINANCING

The Islamic Home Financing facility is to assist you in financing the purchase and/or construction of a property. The bank offers home financing products for customers using contracts such as Diminishing Musharaka, Murabaha, Ijara, and Istisna.

WORKING CAPITAL FINANCING

Working Capital Financing (WCF) is a financing facility for the purchases/importation of goods, raw materials, etc. As required by the customer for their business operations. Agib Bank offers this financing through Mudaraba or Wakalah working capital financing.

VEHICLE FINANCING

The Islamic Vehicle Financing facility is to assist you in purchasing a motor vehicle of your choice. The Financing provides customers with the facilities to purchase a vehicle under the contract of Murabahah or Lease to Own (Ijarah Muntahia Bittamleek).

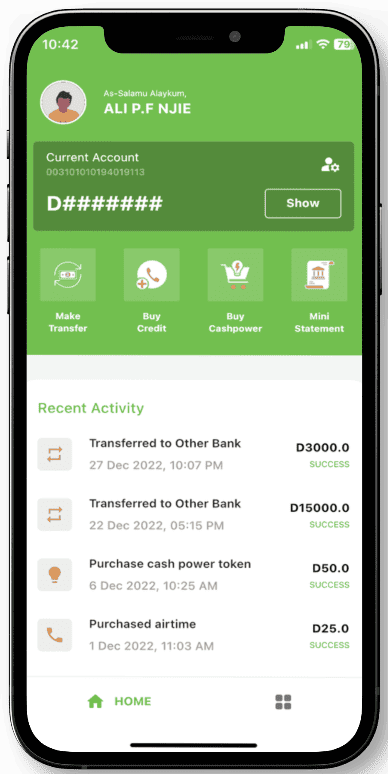

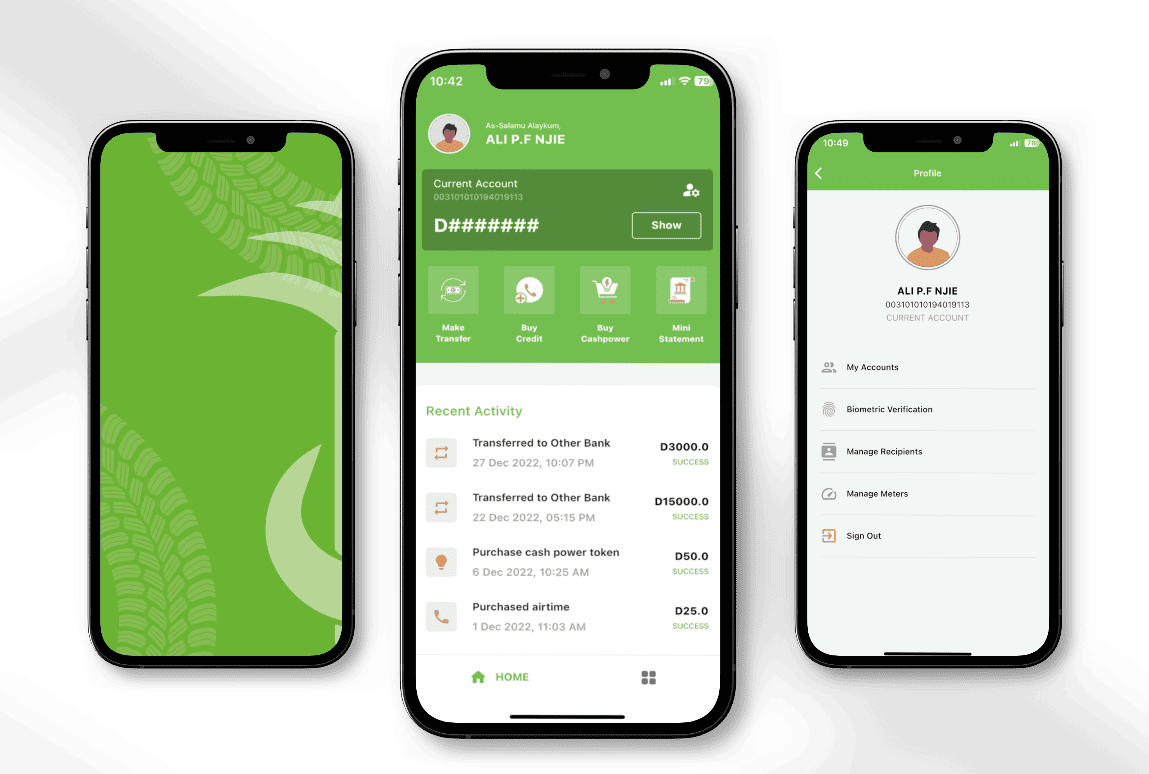

Agib Mobile App

A banking platform that is safe, secure and reliable.

Agib Online Banking

Bank in the comfort of your home with ease.

Agib ATM Card

Available 24/7 for all of your daily transactional needs.

Download Mobile App

Our Mobile App is available on both the Google Play Store (Android) & the Apple App Store (iPhone) to download.

Why Choose Agib Bank?

Non Interest Banking

Always say no to Riba!

Partnership

We share Risks and Profits

Financial Inclusion

No one is left out